It’s a rainy morning, and you’re sipping coffee at your kitchen table. With a few taps on your tablet, you check the market prices, review your accounting for the week and adjust the sensors in your grain bins. This is the new reality of modern farming: technology making your operation smarter and more efficient. But what if that peaceful morning was shattered by a message popping up on your screen, locking you out of your system with a ransom demand? This isn't just a problem for big companies anymore — it's a very real danger for farms of all sizes. The most successful farmers today aren't just experts in crops and livestock; they are also taking steps to protect their business from modern online threats.

Cybercriminals are targeting farms with scams that find weak spots in a farm's computer network. Here are some common dangers:

This is a trick where you get a fake email that looks like it's from a group you trust, like a government office or a local supplier. Their goal is to get you to click on a bad link or give them your private information.

This often happens after a fake email. A criminal might break into a business's email and send a fake request for a money transfer to a new account. These scams can be very costly because the money is usually gone for good. Taking proactive steps to keep your business safe from wire fraud is very important.

Farmers looking for online deals on farm equipment are often targeted. Scammers post fake ads for tractors or livestock and disappear with your money after you pay.

This is a serious threat, especially for larger farms. Hackers lock you out of your computer files and demand money to give your bank access.

If you suspect you’ve been a victim of a cyberattack — whether it’s a fraudulent wire transfer or a ransomware message locking your files — act quickly. Contact your bank or financial institution immediately. Next, report the incident to local law enforcement. Responding quickly is often the best way to minimize the damage and financial loss.

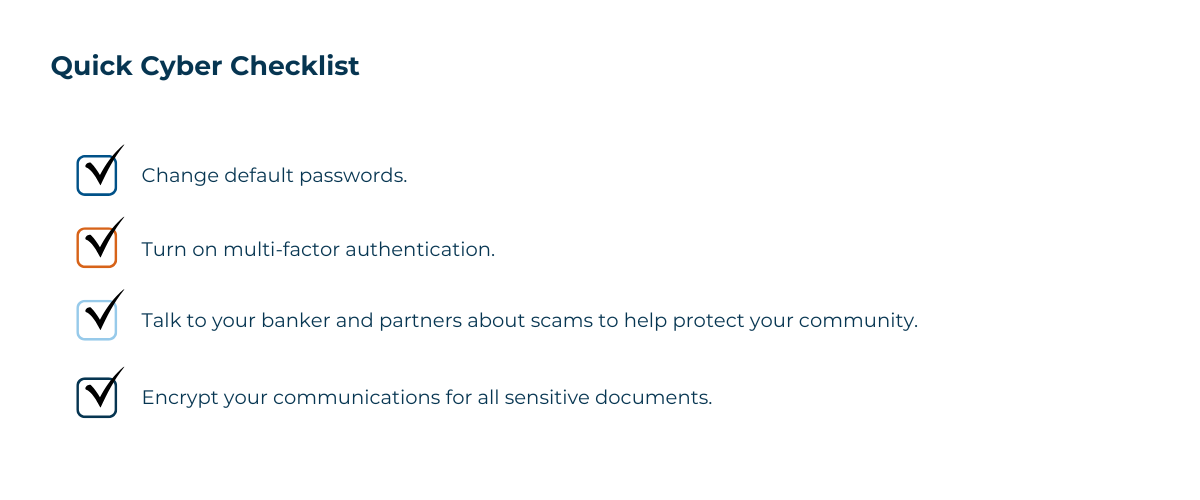

Many farmers ask how they can protect against cyber threats without spending a lot of money. The most effective defense is a combination of common sense and a few key practices in small business cybersecurity.

The most crucial piece of advice for online safety is to trust your instincts. If an email seems too good to be true, if a pop-up appears out of nowhere, or if a supplier’s website looks a little off, don’t click on anything. Always verify information from a trusted source, like a phone number you already know.

This simple step is one of the most powerful cybersecurity tools against fraud. It requires a second form of verification — like a code sent to your phone — in addition to your password. This makes it nearly impossible for a fraudster to access your accounts.

Don't hesitate to reach out to your local banker or trusted business partners when you hear about a scam. In a close-knit community, sharing information is one of the best ways to protect each other.

When sending sensitive information like tax returns or financial documents, use encrypted email. This ensures that your confidential information is protected and isn't sent through an unsecured channel.

Beyond the computer screen, modern farms also face a unique set of security challenges due to the integration of technology into operations. Smart tractors, automated irrigation systems and livestock monitoring sensors are all connected to the internet and are part of your farm’s digital ecosystem. It is crucial to treat these devices with the same vigilance as you do your desktop computer.

For example, you may use a smart irrigation system that you control from an app on your phone. If this system still uses its factory default password, a hacker could easily gain access. They could then shut down your water supply at a critical time, damaging your crops, or could even use this connected device as a way to get into your main farm computer to steal financial data or personal information. To prevent this, make sure that default passwords on all equipment are changed and that all software are kept up to date.

A community bank can be one of your strongest allies in the fight for farm cybersecurity related to money. Unlike larger institutions, local bankers often know their customers personally. This relationship is a critical digital security measure. A banker who knows your transactions is more likely to spot and question an unusual request, like a large wire transfer to a location where you've never done business. This type of proactive communication and mutual trust can prevent a scam before it ever takes place.

Important questions to ask your banker:

Experience the Northwest Bank difference--the better banking experience. Contact us today and let's build a brighter financial future together!

Mon - Fri: 7:00 AM - 7:00 PM CST

Sat: 8:00 AM - 12:00 PM CST

General Support: 800-678-4105