.png?sfvrsn=b6a60bf3_1)

Is your debt keeping pace with your growth? Many small business owners find that the financing that worked for them initially is holding them back as they grow. Refinancing is your opportunity to hit the reset button — lowering monthly overhead, simplifying your payments and freeing up cash for your next opportunity. From SBA 7(a) programs to equipment term loans, this article breaks down exactly when to make your move and how to secure the terms your business has earned.

The best time to look at refinancing is when your business reaches a new milestone or the market shifts in your favor. Recognizing these internal and external factors helps you secure the best terms at the right moment.

Internal Indicators

Business growth is often the strongest signal to refinance. For example, a recent jump in revenue or profitability proves that your business model is working, which makes you an attractive borrower to a bank. This growth typically builds equity, providing you with more collateral than you had when you applied for your original loan.

External Market Factors

Broader economic shifts also offer opportunities for refinancing. If interest rates have gone down since you secured your original loan, refinancing allows you to lower your overhead. Lenders also frequently introduce new programs, such as specialized SBA 7(a) options, that might not have been available when you started your business.

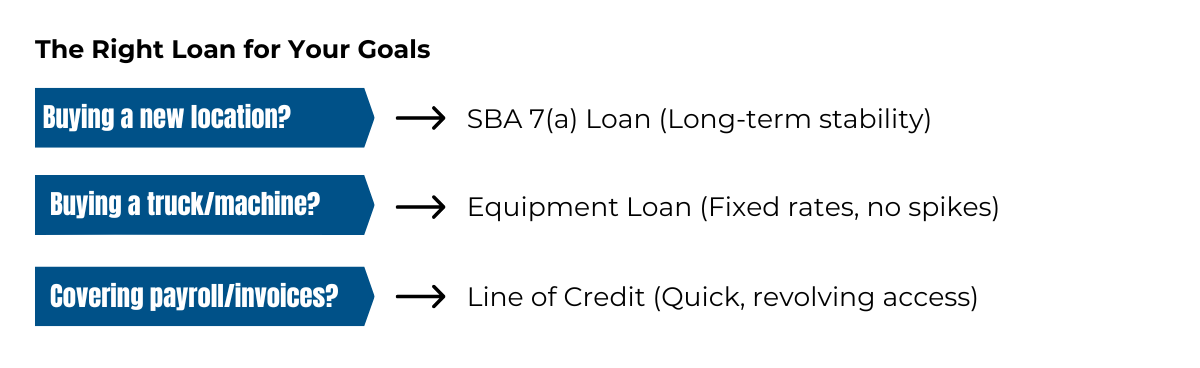

After you’ve identified that now is the right time, look into a loan structure that matches your specific business goals. Here are a few options:

Only certain banks are preferred lenders that can provide an SBA loan. Northwest Bank is a preferred lender that often looks to the U.S. Small Business Administration (SBA) programs, such as the SBA 7(a), to restructure debt for long-term stability. These programs are ideal for businesses undergoing significant changes, such as rebranding or buying a new location. For example, if you just purchased a second store, an SBA loan can provide the flexible repayment structure and longer terms you need to keep your monthly payments manageable while you get the new location up and running.

If you recently purchased machinery using a high-interest line of credit or a short-term rate, you may be vulnerable to sudden interest rate jumps. Moving that debt into a dedicated equipment term loan locks in a stable payment and protects your monthly budget. Imagine that your construction company bought a new truck on a 12-month "no interest" rate. By refinancing into a term loan before that rate expires, you can avoid a spike in interest and keep your cash flow steady.

A business line of credit helps you bridge the gap between project milestones, such as covering a biweekly payroll while you wait for a client to pay an outstanding invoice. The goal is to keep your line of credit loans open and available for these short-term needs or unexpected emergencies, rather than tying them up with long-term equipment debt.

As you look into these loan options, understand the difference between the types of funding available to you. A common question business owners ask is whether or not a small business loan is an installment or revolving. Most refinancing involves an installment term loan, where you receive a lump sum and pay it back over a fixed period with a predictable monthly payment. A business line of credit is revolving, meaning you can draw and repay funds as needed.

Be careful to avoid quick-fix short-term loans that promise fast cash but carry daily or weekly repayments. Instead, lean into the stability of SBA 7(a) programs or traditional bank term loans, which offer the longevity your growing business needs to stay healthy.

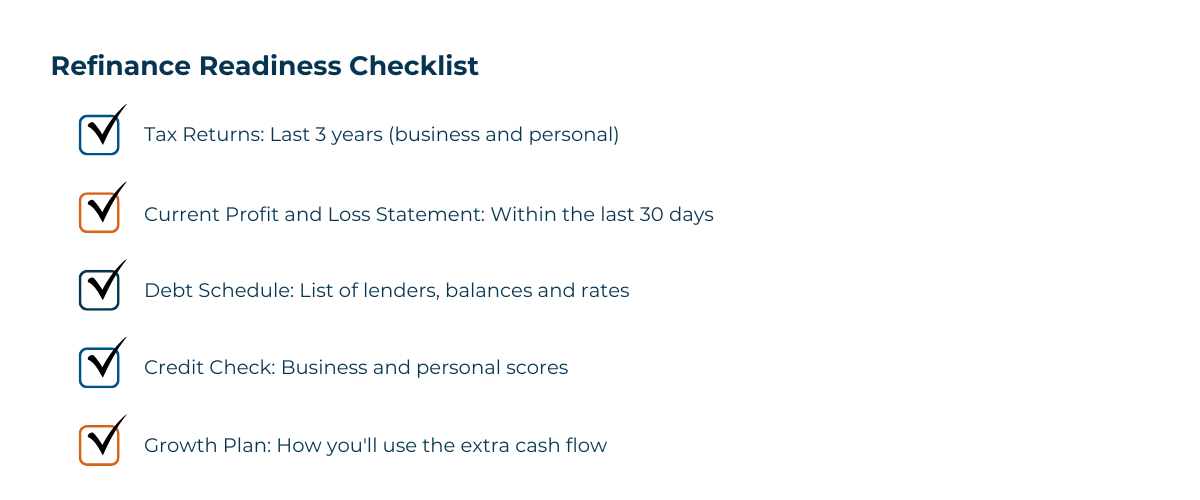

Once you have identified the loan option that best fits your business, you can help speed up the process by gathering the essential information that shows your business’s financial health. Modern accounting programs make this easier than ever, allowing you to pull digital reports to give your lender a clear picture of your success. To get started, you should have:

The biggest delay in refinancing is often inconsistent documentation. Taking an extra week to reconcile your documents and statements helps you present yourself as a low-risk, high-reward partner for the bank.

The most important consideration in your refinance journey isn't a document; it’s a conversation with a community bank near you that understands your needs. Be proactive and reach out to your lender at least once every year to review your finances and current market rates. A simple conversation can help you adjust your rates, extend your terms and make sure your debt is working for you.

Reach out to our team of commercial bankers today to help you navigate your next chapter of success.

Experience the Northwest Bank difference--the better banking experience. Contact us today and let's build a brighter financial future together!

Mon - Fri: 7:00 AM - 7:00 PM CST

Sat: 8:00 AM - 12:00 PM CST

General Support: 800-678-4105