Imagine that you’re always one step ahead of the competition. You’re able to invest in new technology, expand your team and even offer customers flexible payment options, all while your competitors are struggling to make ends meet. It’s not just about making a profit — it’s about mastering cash flow. We’ll guide you through understanding, analyzing and leveraging your cash flow to help grow your business.

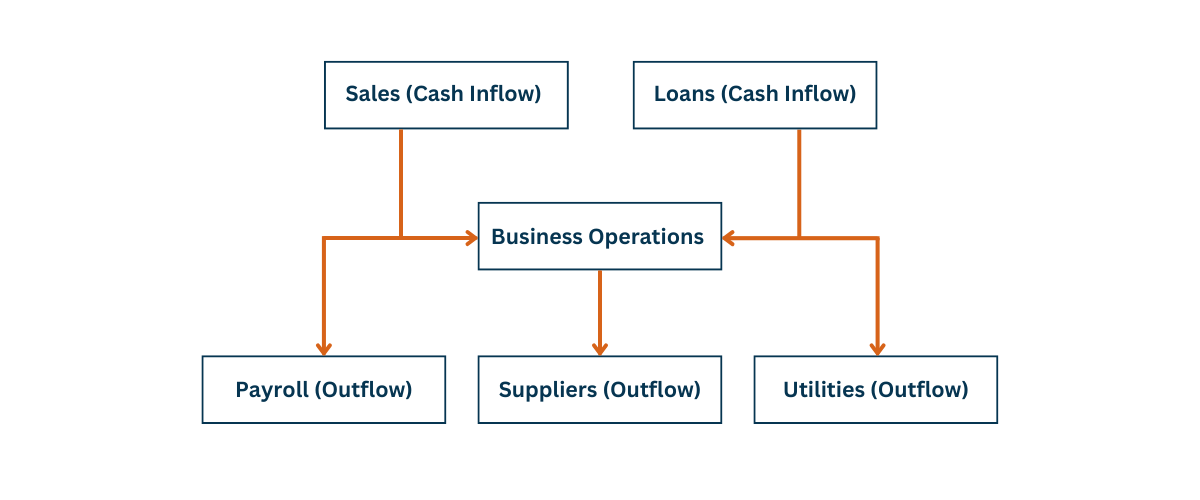

It’s important to understand cash flow because it’s one of the key measurements for your business — arguably even more important than profits. Cash flow is the net amount of cash and cash-equivalents flowing into and out of your business. It accounts for everything your business pays out, like payroll, suppliers, loan payments and utilities, as well as everything that comes in from sales, accounts receivable and loan advancements. Cash flow is different from cash on hand. Cash on hand is the total amount of cash your business has readily available to operate.

It’s possible for your business to be profitable on paper but still not have enough cash to cover expenses. This often happens with businesses that have longer payment cycles. For example, if you’re a small hardware store, you might sell a product on credit, recording the sale and its associated profit immediately. However, you might not receive the cash until your customer pays the bill later. You’ve already paid your supplier for that product, so you experience a negative impact on your cash flow, despite the positive impact on your profit.

Another example is if a business sells a product to a customer, which may be another business, but gives them a term of 90 days to pay the invoice. The sale will help the company’s profitability, but they will need cash flow from previous sales or other sources to pay for operational expenses until the invoice is paid.

A good first step for how to manage cash flow as a small business is to understand what can lead to a negative cash flow for businesses. Here are a few common problems:

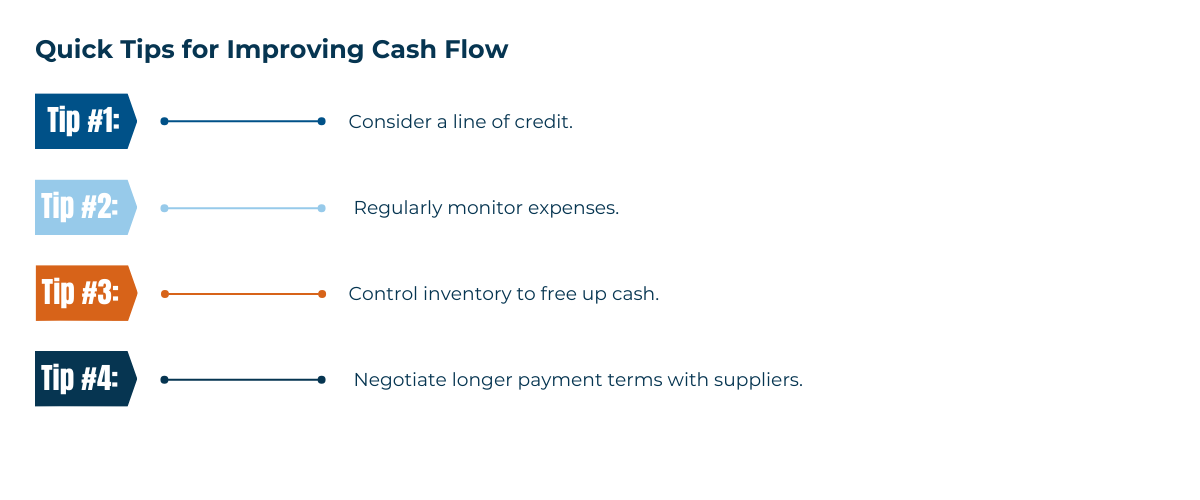

When clients or customers take too long to pay their invoices, it leaves your business without the cash it needs to pay its own bills. For instance, if you’re granting your customers a 90-day payment term, you could consider scaling that back to a 10-day payment term or levying a fee if they wait longer than 10 days to pay on their invoice.

Holding onto excess or slow-moving stock ties up cash that could be used for other critical expenses or investments. Instead, you could use sales data to order more conservatively or sell excess stock at a discount, recovering cash and making room for new inventory.

Uncontrolled spending, high overhead and expensive debt repayments can quickly deplete your cash reserves, leaving little to work with. A solution could be to explore refinancing your business loan at a lower interest rate to reduce the monthly payment or downsizing to a more affordable office space to lower a major fixed cost.

Even if sales are strong, low-profit margins mean a smaller amount of cash is kept from each sale, which can make it difficult to cover costs and build a reserve. Think of a restaurant with servers who don't properly record sales, or a greenhouse that suffers a loss from unsold flowers after a holiday. In these situations, a business should increase its profit margin to make sure it has adequate small business cash flow.

Without a clear picture of future income and expenses, your business can't prepare for financial shortages, especially during slow periods or when facing unexpected costs. It’s important to use a cash flow statement to help improve your cash flow.

What is a cash-flow statement? A cash-flow statement is a powerful tool that presents you with all of your cash inflows, minus outflows, to tell you how much cash on hand you have to operate the business. There are three main components:

It’s recommended that you complete a cash-flow analysis at the same time each month to avoid any inconsistencies between inflows and outflows. If you see that you have less cash on hand than you thought you would, you can see where your money is going and decide if you need to cut costs or adjust your pricing to increase your margin.

Most accounting software products, like QuickBooks, can generate a cash-flow statement for you. If you don’t use software, an accounting or bookkeeping firm can also provide cash flow statements.

All senior-level managers, the manager of accounting and finance, the sales manager and any other managers who control cash items should be involved in a cash-flow statement analysis to discuss prices, payment terms, upcoming sales, etc., to make sure your cash flow is adequate.

A commercial banker is also a valuable partner in reviewing cash-flow statements, offering insights on where money is going and helping you make decisions on how to increase cash flow so your business can thrive. Contact a commercial banker today to learn more.

Experience the Northwest Bank difference--the better banking experience. Contact us today and let's build a brighter financial future together!

Mon - Fri: 7:00 AM - 7:00 PM CST

Sat: 8:00 AM - 12:00 PM CST

General Support: 800-678-4105