Collecting and processing payments doesn’t have to be a challenge, even if you receive a large volume of payments from customers. You can enlist the help of time-saving banking services, like lockbox payment processing solutions, to help you manage your payments in a simple and more secure way.

In this article, we dive into five of the most frequently asked questions from small business owners about what lockbox systems are, how they work and the benefits of using this service.

A lockbox payment system is a bank-operated service to help you receive customer payments. Instead of payments being mailed to your business, they are sent to a physical post office (P.O.) box where they’re collected by a third-party processing team. The payments are opened, sorted and scanned directly at the processing center. Once that is completed, a file of the checks is created and sent to your bank for deposit into your account. All pertinent documents and information in the remittance envelope, including the correspondence, are scanned and uploaded to a secure website that can be accessed anytime. In addition, the system can download a report into your business’s accounting software to automatically balance accounts.

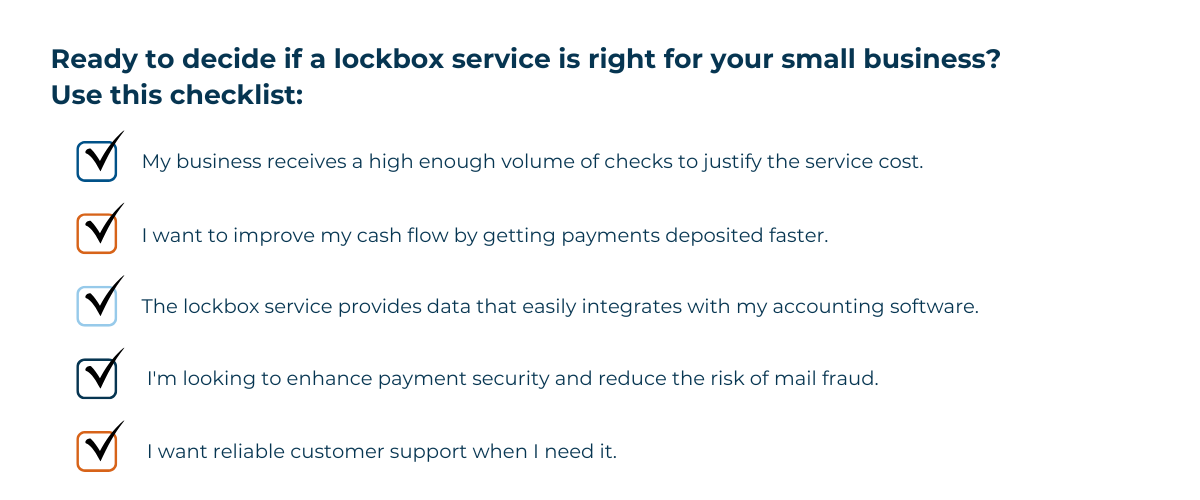

Determining whether you should use a lockbox service comes down to two things:

For example, large medical companies receive thousands of payments a month. A lockbox service would help streamline payment processing as well as free up time for staff to focus on other areas of the business. However, the service isn’t limited to large organizations; it can be useful if you are a startup business and do everything from selling your product or service during the day to handling all the accounts receivables at night.

A lockbox service is beneficial if you:

There are many advantages to using a lockbox service. The biggest is that it gives you more flexibility with your cash. Since deposits are delivered directly to your bank account, it speeds up the receipt of payments; therefore improving cash flow. With a faster payment schedule, accounts receivables are more rapidly updated, providing you with better insight into which customers or services are more profitable.

Lockbox services also help reduce staff workload. If you own a smaller business, it's not uncommon for your employees to wear multiple hats. They may have to process payments on top of their regular job responsibilities, which is where lockbox can help. The service takes away some of that heavy lifting from your staff, which can be a huge cost savings to your business.

Bank lockbox services also increase the security around your payments since you have a dedicated address for only your payments only. If all your mail is coming to your small business office, there’s room for error, such as payments being misplaced or even stolen.

Finally, a lockbox system gives you the best of both worlds: you get to partner with a smaller bank but still access the advanced services of a larger financial institution.

The cost of lockbox services varies depending on the bank you work with; however, there is usually a monthly cost and an item transaction fee. Northwest Bank works with you to give you the services that fit your needs without overselling you on unnecessary options.

It can take anywhere from two weeks to a month to get the payment processing solution going. The bank will create the physical P.O. box and format the files and images. While most of the upfront work takes place on the bank side, it does require you to communicate with your customers about your new mailing address, so they know where to send payments.

If your business regularly receives a large number of check payments and your accounting team is feeling the burden, then payment automation with lockbox services can be a smart option for your small business. Reach out to one of our Treasury Service Representatives today to learn more.

Experience the Northwest Bank difference--the better banking experience. Contact us today and let's build a brighter financial future together!

Mon - Fri: 7:00 AM - 7:00 PM CST

Sat: 8:00 AM - 12:00 PM CST

General Support: 800-678-4105