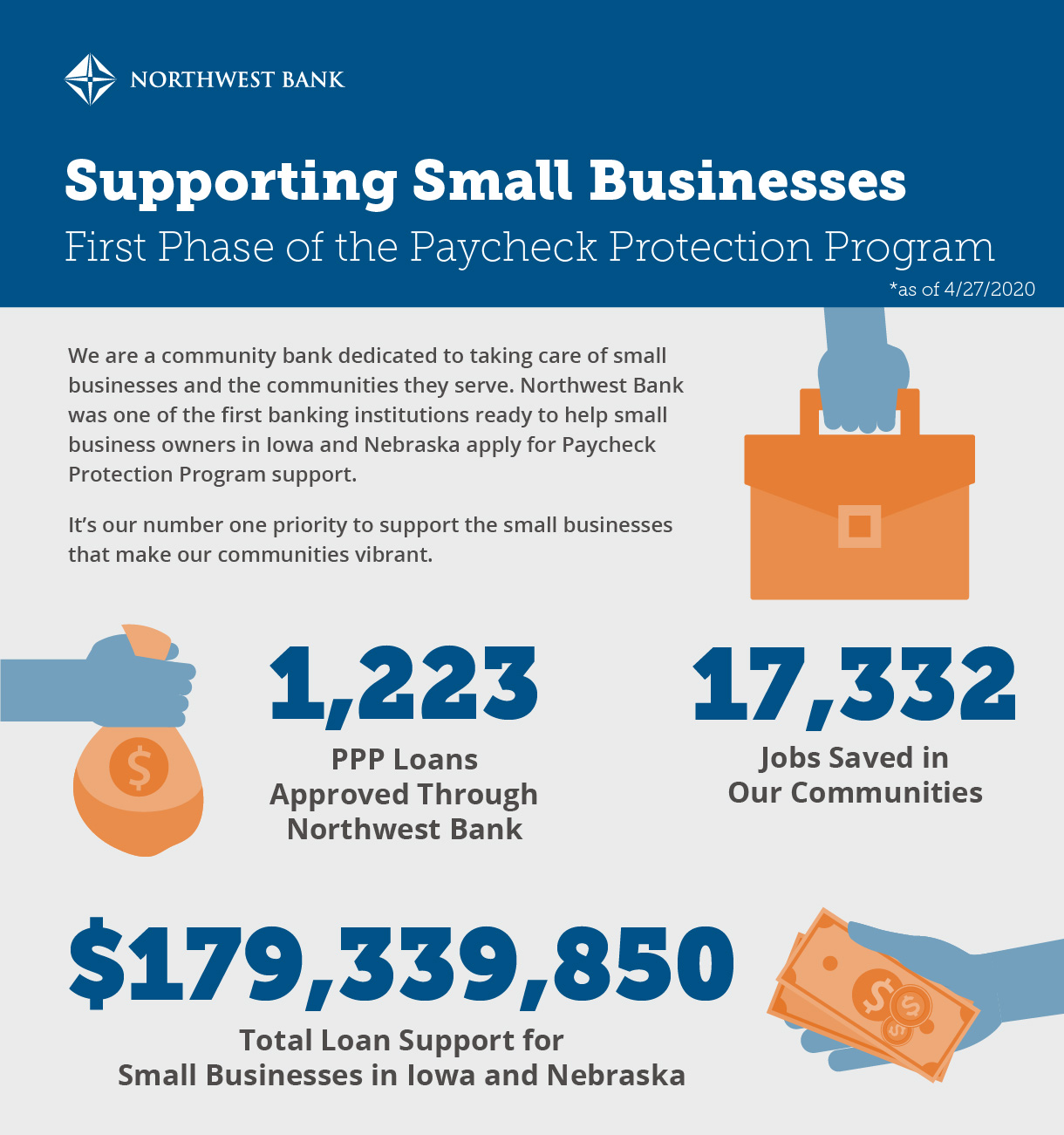

We are a community bank dedicated to taking care of the small businesses and the communities they serve. Northwest Bank was one of the first banking institutions ready to help small business owners in Iowa and Nebraska apply for Paycheck Protection Program support.

The SBA and the U.S. Department of the Treasury created the Paycheck Protection Program (PPP) to provide funding relief to help Americans employed by small businesses. These loans are offered by local community banks, including Northwest Bank, and backed by the SBA.

It’s our number one priority to support small businesses that make our communities vibrant. During the first phase of the Paycheck Protection Program we were able to approve 1,223 loans for a total of $179,339,850 in total loan support for small businesses in Iowa and Nebraska. Through the loans we were able to help small businesses secure 17,332 jobs were saved in our communities.

Visit us online for more details about the Paycheck Protection Program.

We understand the stress being put on the small business community, and we are dedicated to helping you navigate the relief options available to small business owners. Our highest priority is to keep our employees, customers and community safe.

As we work to slow the spread of the coronavirus, our bank locations will have limited lobby access by appointment only. Please contact us online to schedule an appointment with a Business Banker.

Experience the Northwest Bank difference--the better banking experience. Contact us today and let's build a brighter financial future together!

Mon - Fri: 7:00 AM - 7:00 PM CST

Sat: 8:00 AM - 12:00 PM CST

General Support: 800-678-4105