You've taken a monumental step and purchased a business. The ink is dry, the keys are in your hand, and the future is full of potential. But as the excitement settles, you may be asking yourself: "Now what?" The first few months after acquiring a business are crucial and set the tone for future success. This comprehensive checklist is your essential guide to help your new venture thrive.

Buying an established business means you're inheriting a brand with a community history. While this is a huge advantage, it also presents a unique challenge: change can be hard for existing employees and customers.

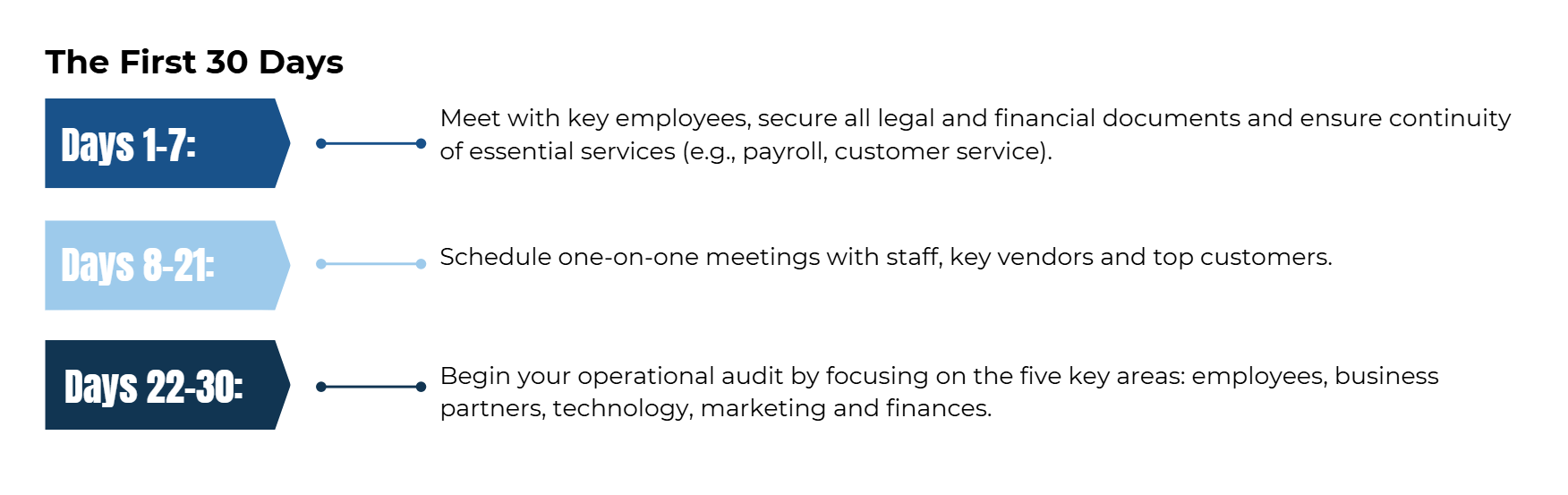

Your first major task as the new owner is to start with an operational efficiency audit. Ask yourself “What needs to stay the same, and what needs to change?” To keep business operations moving in the short term, you don’t have to make big changes overnight, but eventually you will want to put your own stamp on things.

As you consider changes, there are several questions you should ask as part of your business acquisition checklist:

By auditing the business operations of your small business, you can introduce new efficiencies after stepping in as the new leader. Let’s explore the key areas to focus on.

Building a strong team starts with understanding the one you've inherited. Begin by looking at the existing employees' roles and performance. You may need to add staff if you plan to expand operations or introduce new services. You might consider downsizing your workforce if the business has become more efficient or if certain employees aren’t a good fit for new vision and culture.

The previous owner will have established partnerships with vendors who supply goods to the business. Look at the vendors and suppliers the previous owner used and audit to make sure you’re still getting the best prices and highest-quality products available.

Don’t overlook your team of professional experts: the business’s CPA, lawyer and commercial banker. While the existing group may have years of experience with the business, make sure they are a good fit to work with you. Interview them to see if their expertise aligns with your goals for the business.

If the previous owner was in business for a long time, there’s a good chance their technology is outdated, or they haven’t embraced technology at all. Take a close look at everything from computers to point-of-sale systems and inventory tracking systems. New, more efficient technology can help streamline processes, cut costs and improve your customer experience.

Also look at the business’s online presence. Is the company already on social media? If not, you’ll want to start business accounts on platforms that your target audience is using and are best suited to your type of business. This gives you the opportunity to get the word out about your products and services as well as interact with current and potential customers.

Also, make sure your website looks modern and, if it’s not already available and in use, consider adding online shopping to your website and social media channels if appropriate for your business.

Marketing has come a long way over the past 20 years. While traditional advertising media like print, radio and local television still have a place, modern marketing focuses more on digital channels. Transitioning your marketing efforts to platforms like social media and search engine advertising is effective and cost-efficient. You can advertise on social platforms like Facebook, X (Twitter) and LinkedIn, as well as on search engines like Google, Bing and others, to reach customers when they are looking for your products or services.

Setting up new business finances is one of the biggest decisions you’ll need to make. First, decide if you’ll continue the business’s relationship with its current bank or switch to a new financial institution. Next, work with a commercial banker to explore your financial options, such as:

You’ll also need to audit the financial reporting and documentation process. Businesses from previous generations may have outdated or inadequate reporting procedures. Work closely with your CPA to make sure that your business finances are accurately tracked and reported.

Taking ownership of an established business with a reputation in the community is an exciting new challenge. As you look at existing processes and business operations, be sure to consult your CPA, lawyer and commercial banker to help you make changes and find operational efficiencies.

We have experience helping entrepreneurs buy existing businesses. Check out this blog article to see how our services helped Rob and Carol Gilbertson put their own spin on The Prime Rib, a restaurant in Spencer.

Experience the Northwest Bank difference--the better banking experience. Contact us today and let's build a brighter financial future together!

Mon - Fri: 7:00 AM - 7:00 PM CST

Sat: 8:00 AM - 12:00 PM CST

General Support: 800-678-4105