At the end of the year, you are likely juggling a lot — finalizing orders, managing schedules and, of course, preparing for the coming year. But this is also the best time to focus on your business finance strategy. Amid all the hustle, take a step back and evaluate how your treasury management solution supports your company's financial goals. This is the software and tools that help you manage your cash, optimize payments, and make smarter, data-driven decisions.

Learn why year-end is the perfect time to review your treasury management system, and how doing so can help you strengthen your business’s financial health in the year ahead.

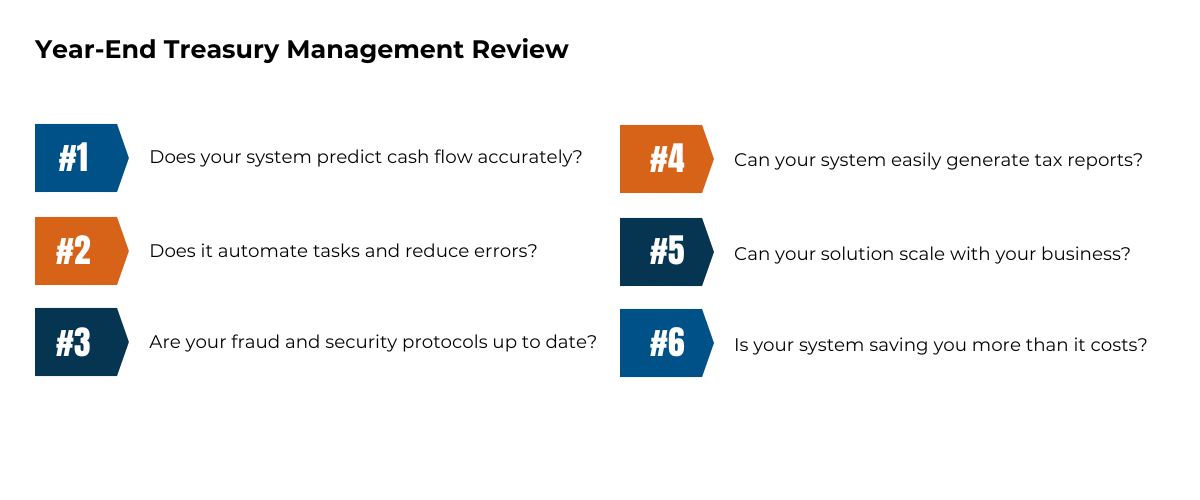

To help your businesses stay financially healthy, your treasury management solution should have accurate cash flow forecasting. It can help you predict the inflow and outflow of cash over a specific period. A strong system can help automate this process by pulling data directly from your accounting systems, invoicing and bank accounts. This real-time integration gives you up-to-date forecasts so you can adjust. For example, if sales are predicted to slow down in a certain quarter, or if you anticipate higher-than-usual expenses, you can plan to ensure that you have enough cash to cover these fluctuations.

A key function of your treasury management system is also long-term financial planning. It can help you stay ahead of potential issues, such as delayed customer payments or shifts in market conditions, allowing you to take action, like adjusting payment terms or securing small business financing.

As your small business grows, so does the complexity of managing your finances. Streamlining treasury management functions through automation can help save time and improve the accuracy of financial records. At year-end, review how your treasury management solution handled these tasks. Ask yourself: Did your system automate tasks like bank reconciliation or payments? Did it consolidate data from multiple accounts into a single, easy-to-read report? A service that automates routine tasks can save hours each week and reduce the risk of errors.

Your small business is exposed to a range of financial risks, from unexpected cash flow shortages to fluctuating interest rates. Evaluate how well your treasury management solution has helped you throughout the year. A robust treasury management solution can provide powerful tools to manage these risks by tracking market conditions, such as interest rate changes. It can also help monitor your cash flow, ensuring that you have enough to cover unexpected expenses.

Another key aspect of improving risk management is preventing fraud and ensuring that your financial systems are secure. A system with built-in fraud detection and security features, such as multi-factor authentication and transaction monitoring, can help protect your business. Tools like Positive Pay can be used to verify checks: preventing fraudsters from cashing altered or counterfeit checks. Review your treasury management security protocols to make sure they align with the latest best practices and regulatory requirements. And look for features that allow real-time alerts and automated notifications when suspicious transactions are detected.

4. Ensure Compliance and Year-End Tax Planning

4. Ensure Compliance and Year-End Tax Planning Staying compliant with tax laws and regulations is essential not only for avoiding fines and penalties but also for maintaining a strong reputation and financial health for your small business. As regulations evolve, assess whether your treasury management system is keeping up with the latest tax and regulatory requirements. It should help you generate tax reports that are in line with current regulations as well as track required information for year-end tax planning, like sales tax and payroll tax. This is especially important because tax laws can change from year to year or even within different jurisdictions if your business operates in multiple locations.

Also, a treasury management solution can help streamline the process of maintaining proper records for audits: providing easy access to transaction history, bank statements and other essential documents to help with year-end tax planning. You’ll be less likely to forget necessary tax filings or payments, which can be a common issue during busy periods.

Your financial needs will become more complex as your small business expands. Evaluate whether your current treasury management solution can scale with your company. It should be able to handle more data and multiple bank accounts without a decrease in performance.

Is your system flexible? As you explore new opportunities, whether through expanding locations or offering more financial products, your treasury management solution should be able to integrate with other financial systems or third-party payment platforms. This ensures a seamless flow of financial data across all your operations, saving you time and reducing the risk of errors.

Look at your expenses to determine whether your treasury management service continues to be cost-effective for your business. Consider both direct costs, like subscription fees or maintenance charges, and any indirect costs, such as the time spent on training and setup. Compare these costs with the efficiencies and time savings your treasury management solution has delivered. For example, features like automated bank reconciliation or invoice processing might have saved you significant labor costs, which may offset the subscription fees.

Also, measure the return on investment (ROI). A good treasury management solution should reduce operational costs and provide value through improved decision-making and better cash management. If the system has provided better visibility into your financial position or allowed you to negotiate more favorable terms with vendors or lenders, then it is likely providing a strong ROI. However, if it’s underperforming or not fully aligned with your needs, you may want to explore alternatives.

If your current treasury management solution isn’t helping your business, take steps to implement a new service. Your local community bank can give you advice on what works well with their systems to help you streamline your treasury management process. Reach out to our Treasury Management team today to support your small business.

Reviewing your treasury management processes can help save you time, reduce risks and set your business up for success in the year ahead.

Experience the Northwest Bank difference--the better banking experience. Contact us today and let's build a brighter financial future together!

Mon - Fri: 7:00 AM - 7:00 PM CST

Sat: 8:00 AM - 12:00 PM CST

General Support: 800-678-4105