You’ve found the perfect building, the ideal piece of machinery, or a business acquisition opportunity that’s too good to pass up — but there’s a catch. The down payment is too high, or your collateral doesn’t quite meet traditional lending standards. This financing gap is a common hurdle for small businesses, but it doesn’t have to be a dead end. By leveraging SBA loan programs, business owners can secure the funding they need with as little as 10% down, preserving vital working capital for daily operations. From the multi-purpose 7(a) loan to the real-estate-focused 504, SBA financing is designed to reduce bank risk and maximize your opportunity for success. Let’s discuss the basics of SBA lending, eligible uses and how these programs can help you fund your next step.

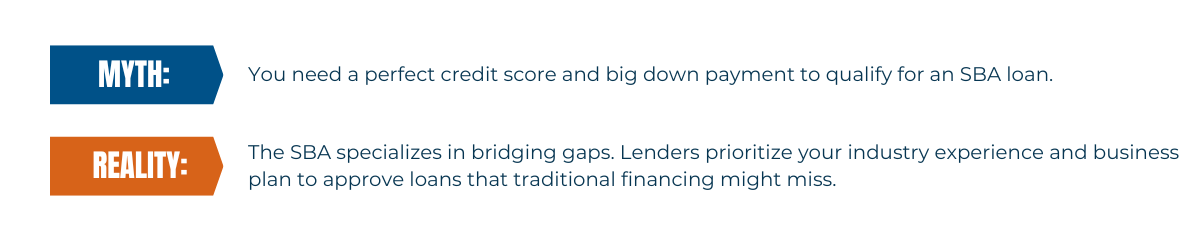

Small business owners in various industries, including professional practices, often utilize an SBA commercial loan instead of a traditional bank loan because the SBA program is designed to secure financing when other options are out of reach.

There are many advantages of an SBA loan, but the primary reason small business owners turn to one is to address a collateral shortfall. Whether you are purchasing equipment, office furniture or building space, the SBA provides a guarantee that minimizes the bank's risk. This allows banks to finance business opportunities — for example, if you’d like to buy an existing business or launch a new venture — that wouldn't meet standard bank financing requirements.

SBA loans can significantly reduce the amount of cash you need to contribute upfront. SBA loan down payments can be as low as 10%, depending on the specific financing request, helping you keep more of your own capital for other critical business needs like hiring or marketing.

Many small business loans are restricted to a single purpose; however, the SBA 7(a) loan is a multi-use tool that can be used to solve complex challenges. It’s the most versatile option among SBA loan programs.

Here are a few strategic ways you can put an SBA 7(a) loan to work:

If you need a loan for commercial property or a long-term investment in heavy machinery, the SBA 504 loan is the right fit. Unlike other options, the 504 program is specifically for major fixed assets, offering up to 90% financing. It typically has long-term, fixed interest rates that provide your business with predictable payments.

A good example is if you own a manufacturing company that needs to move into a larger $1 million facility to meet rising demand. Under a traditional loan, a bank might require a 20% down payment ($200,000), which can be a strain on a growing company's cash. With an SBA 504 loan, a bank could provide $500,000, the SBA-backed Certified Development Corporations (CDC) could add $400,000, and you might only need to provide $100,000. While all situations vary, it could save $100,000 in upfront cash — capital that could then be used to hire new employees or purchase materials needed to fulfill new orders.

The SBA express loan features a quicker turnaround time for approvals, making this the ideal option for responding to a sudden equipment failure or a time-sensitive expansion opportunity.

By working with an SBA preferred lender, you can apply for an SBA express loan to purchase a replacement vehicle immediately. If your bank is an SBA preferred lender they have the authority to fast-track the decision, and you may get approval in days rather than weeks.

While the loan application timeline can vary, the process is streamlined when you work with the right partner who understands SBA financing requirements. Here are a few tips:

Getting an SBA loan is a specialized process, not a standard service. Because these loans come with extra rules and government requirements, many banks find them too complicated to handle. To make things easier for yourself, look for a bank with Preferred SBA Lender status near you, like Northwest Bank. This is a special rank that proves we know the system inside and out. Plus, we have a clear understanding of loan options and can process these loans much closer to their standard loan times. This status is earned through a track record of meeting SBA requirements.

The documents required for an SBA loan are very similar to those needed for traditional loans:

SBA loans can include fees. When fees do apply, they can be included in the loan, spreading the cost over the entire term to prevent an upfront burden.

If you are looking to purchase equipment, expand your real estate footprint or secure working capital, talk with our Northwest Bank business bankers today.Experience the Northwest Bank difference--the better banking experience. Contact us today and let's build a brighter financial future together!

Mon - Fri: 7:00 AM - 7:00 PM CST

Sat: 8:00 AM - 12:00 PM CST

General Support: 800-678-4105